Enshroud Tokenomics

This page explains the basic tokenomics properties of the Enshroud

project.

$ENSHROUD tokens come into existence in two ways:

through Preallocation and via a Tiered Crowdsale.

For the complete discussion in a downloadable PDF format,

click here

.

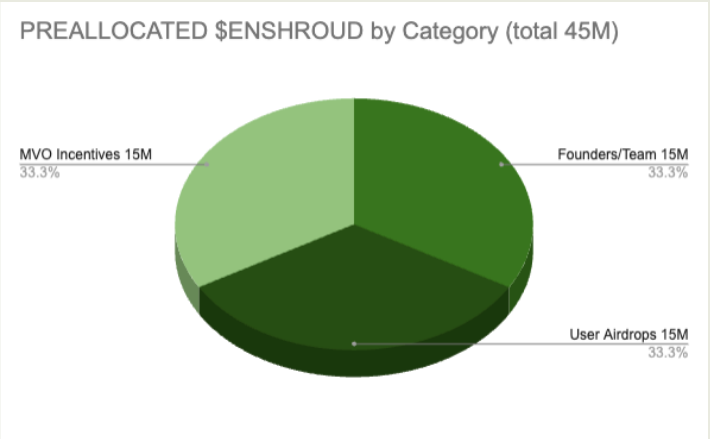

Tokenomics: Fixed Allocations

- Founders/Team tokens all exist at launch, but unlock linearly over 1 year with a 90 day cliff.

- Matching User tokens will be airdropped to qualifying users during year 2 following launch.

- MVO Incentive tokens are earned by MVO stakers to secure the network, paid over 5 years (5M+4M+3M+2M+1M).

- There are no investor or "VC" tokens, because Enshroud was developed privately without any external venture capital funding.

- User Airdrop and MVO Incentive tokens are unlocked upon issuance.

- All $ENSHROUD are governance tokens which can vote in the EnshroudDAO (locked or not).

- Both locked and unlocked tokens can be staked on MVOs, but only unlocked tokens can be staked for a share of fee income (Yield).

Tokenomics: Tier Sale $ENSHROUD

- Beginning at launch, these tokens are sold via a Crowdsale smart contract by the DAO at fixed prices, as shown in the table. These tokens are unlocked upon issuance. Sale proceeds go 100% to Treasury.

- The Tier-1 price ("x") is set at the equivalent of $0.25 USD in ETH at launch (in fact: 0.0000625 ETH, which is $0.25 at $4000/ETH), and will double in each successive Tier. Since this is a quantity of ETH, the USD value will vary throughout.

- Any existing holder can "step in front" of the DAO's Crowdsale to provide secondary market supply at any price.

- The maximum supply therefore depends upon market dynamics.

See the

Tokenomics

document for more detailed information, along with a discussion

of the economics of Enshroud.